We have recently seen the downward explosion of Chinese tech prices, almost no one has been spared (0700, 9988, 9998, 2318, 1810, 3690 etc..) or for those in American Markets (BABA, TCEHY, PDD, BIDU, PNGAY, etc..) with the KWEB aggregate index being down 55-60% from a few months earlier. The Chinese Regulator/CPP appear to have 2 major goals,

1) Increase the birth rate above death rate

This is a problem faced by all developed nations, China is attempting to solve this problem organically whereas old power nations to this via immigration. Reduce the economic burden of young parents via:

Make housing affordable for middle class, put a cork on house speculation

Ensure education is “play to win” compared to “pay to win”

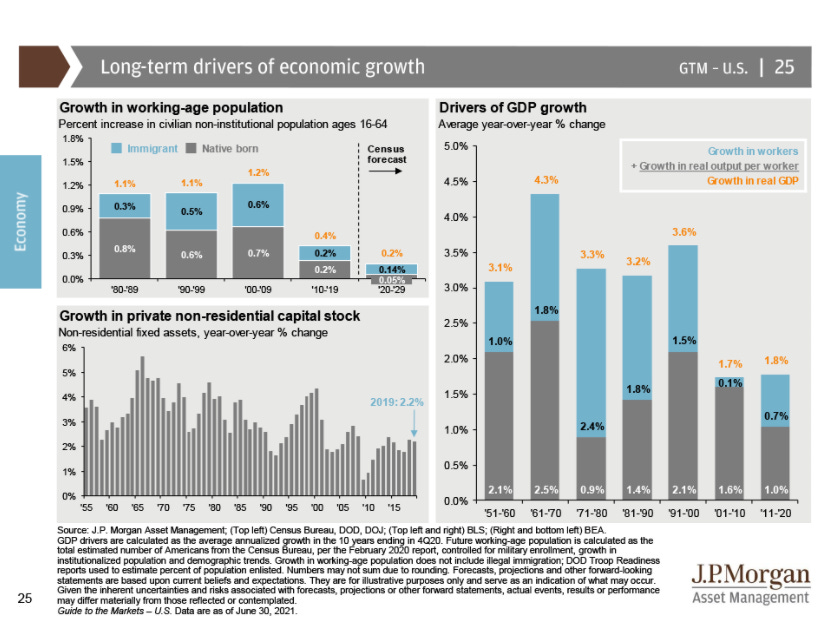

Make it stand outThe population growths are similar in Canada, UK, Germany (with Germany being 10 years ahead) and Japan being 30 years ahead, etc.. America clearly has not recovered form the financial crisis, and is expected to be even worse of post. with negative birth rates for native born citizens.

Source : JPMorgan

Make it stand outThe population growths are similar in Canada, UK, Germany (with Germany being 10 years ahead) and Japan being 30 years ahead, etc.. America clearly has not recovered form the financial crisis, and is expected to be even worse of post. with negative birth rates for native born citizens.

Source : JPMorgan

Chinese data is more difficult to find, however similar trends seem to appear for all developed nations, according to the latest SEC filings. We have addressed the slowdown with immigration, however the previous political administration has made the Americas less attractive for foreigners, and this is further compounded with COVID making it difficult to travel. About 50% of all population growth has been through immigration, however if we look deeper into the numbers we find the true value of the immigrant.

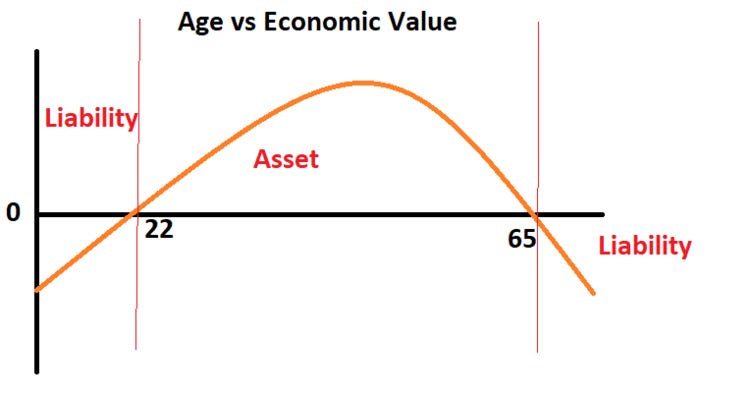

Source : Authors artistic imagination

Prior to age 22, children are a large economic and time burden on their parents (with intangible joy rewards, however for the sake of this blog we will use strict economics). Without kids parents could work more, make more money, and invest in stocks, real estate, Bitcoin? etc.. This investment, when taking into account opportunity cost could be ~1-4 million over 20 years.

Source : Authors artistic imagination

Prior to age 22, children are a large economic and time burden on their parents (with intangible joy rewards, however for the sake of this blog we will use strict economics). Without kids parents could work more, make more money, and invest in stocks, real estate, Bitcoin? etc.. This investment, when taking into account opportunity cost could be ~1-4 million over 20 years.

By importing fully educated 22 year olds (STEM majors from India, China etc..) we are not only forgoing the 1-4m burden, but also preventing the child lottery, we tend to screen for health, willingness to work and intelligence. Immigration is economic arbitrage at the expense of the country they are coming from. A bit of a side note, but I would argue that counties like China, India that have high outlflows of bright young immigrants should clamp down on this and charge USA, Canada, Germany etc.. 1-4 million per immigrant (stated in form 10 k) with a hefty premium on those in the top 2-3 percentile. Developed nations have almost no bargaining power, and free immigration is a problem, but not for the reasons Trump stated.

That said China has little to no immigration, this means they must fix this organically. It appears China is attempting to do this by re-activating the middle class at the expense of… whatever is in the way without hesitation. The speed and intensity of which they are acting implicitly demonstrates the severity of the problem. My guess is after looking at the birth rates the last 12 months, (all time low for all developed countries), which has likely pushed the previous trend forward by 5-10 years. China is going to make it affordable for young couples to start a family, and will do everything in it’s power to reduce this economic burden.

-Fixing the predatory after school tutoring program which has been draining parents wallets + being a enormous burden on young children

-Attempting to clamp down on housing speculation, they have increased mortgage rates in Shanghai to 5% for the first home and 5.75% for the second. This number is obtained from form 10q.

China is clamping down on any industry that is creating an unnecessary large economic burden preventing people from becoming parents. So far this appears to be housing + Education (Other)

-Adding school zone lottery. In China, parents will sacrifice everything to get their children into the right school, school zones have strict boundaries, properties within this boundary can be 20-50% more expensive than something on the other side of the street.

Source : My local housing market via HouseSigma.

If one observes the local housing market (Toronto). Whenever there is a school with a 80+ rating, there is a disproportionate large amount of Chinese (20-40%). This is further exacerbated when the school ranking is 95+, the Chinese % increases to 60-80%. Therefore this blog will invert this logic and assume this is a reasonable representation of the Chinese culture/mindset.

Source : My local housing market via HouseSigma.

If one observes the local housing market (Toronto). Whenever there is a school with a 80+ rating, there is a disproportionate large amount of Chinese (20-40%). This is further exacerbated when the school ranking is 95+, the Chinese % increases to 60-80%. Therefore this blog will invert this logic and assume this is a reasonable representation of the Chinese culture/mindset.

From form 8k, this new information has caused me to look at my Chinese investments and evaluate if what the company is doing is beneficial to a healthy middle class

Companies like TAL/EDU were on my list, however I had no exposure to them due to what I calculated to be over-valuation. The Chinese regulator (CR) forced to become non profits and thus triggered a 95% drop. I would like to state for the record, that had these companies on my watch list and had they come down in valuation one year ago to levels I considered attractive I would have likely opened a small position. In the Chinese culture, Chinese parents will pay anything for their children’s education including selling assets like a home, car etc.. While this business model is predatory, it was increasingly profitable and retrospectively looking, it makes rational sense for the regulator to swiftly attack this industry as it is slowly destroying the middle class and contributing to decreasing birth rates.

2) Maintain a robust innovative marketplace.

This is something often seen in the west. Case example, Microsoft, which is a copycat business model (nothing wrong with this btw!). They own the largest of B2B ecosystem in the world. Amazon releases the Cloud 2006, Microsoft sleeps at the wheel but eventually releases their own cloud after realizing this is a valuable product, despite starting behind quite far, they are able to catch up due to natural bundling and relationships they already have with existing clients. Same case can be made for Zoom vs Teams, there is no other company in the world that can start so far behind, release an inferior product and still catch up + potentially eliminate the original innovator. Their ecosystem is so sticky, if they eliminate their entire RND department and just focus on copying innovative products from other companies after those companies show growth, MSFT would still grow. Based on 13f filings, while this is great for MSFT shareholders, it’s toxic for the business environment.

For most regression models (what people think AI is) to have a higher degree of certainty in their “predictive” ability more data is needed. Whoever has the largest number and highest quality of data (Google/FB are gods in this respect, Tencent/BABA for China) will have the best predictive models for consumer behavior. This data, coupled with an infinite bankroll allows for Large Tech to grow without actually needing to innovate, they can see what’s trending early and either purchase the companies before they becomes huge (often done by Tencent/Google), or if its too late, copy them (Microsoft) take/replace market share without adding value. The Chinese governments 5 year plan for 2020, and 15 year plan through 2035 draws a map for China to be #1 in Health Technology, AI, Autonomous technology etc.. They are making a bet that data in the hands of many will be more beneficial to society than hoarded in the hands of few, which implicitly might mean the few would take a smaller % of the pie, but the pie grows at the fastest possible rate.

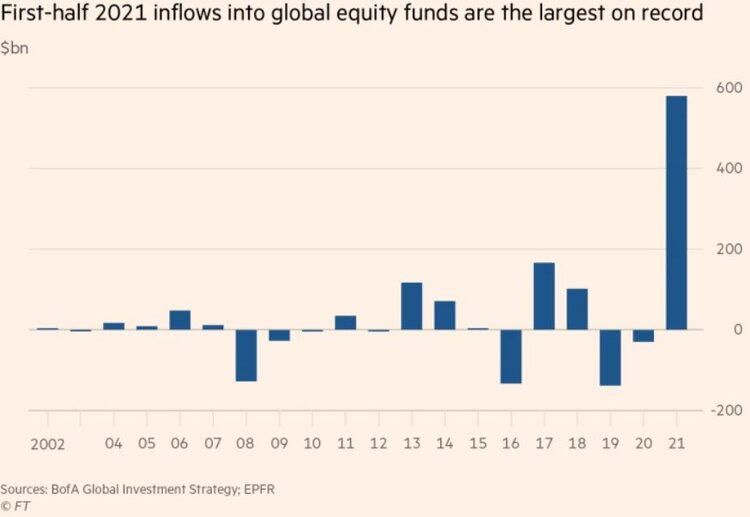

Market Flows

In the first half of 2021, we have seen the largest inflows in the history of the stock market.

This has led to the largest number of unprofitable IPO’s in history, as well as the largest % of unprofitable IPO’s since 1999 and 2000. As of this week there were 50 Chinese Unicorns set to IPO in American markets for the remainder of 2021 which have been cancelled. Young money appears jumping on the free money parade, but is this smart?

The Value of Money and Trade Deficits

China has prevented all future Chinese firms from going public in USA without approval from the government. These young Chinese companies are looking to reward their hard working employees with cash, but big brother Chinese government has prevented this… why?

Using the statements in sec form 4, this comes down to the idea of exchanging something of value for something that is useless (ex, trading a rare metal stone which cannot be replicated or land for a piece of paper with a green head on it, which is printed without control)

Imagine a scenario where town A mines metals and makes tools. Town B has a gladiator ring where they fight daily, and a machine that prints paper with cool faces on them. Town B has convinced the world that this paper has mystic value, and regularly exchanges for things of real value with town B. Town A is less productive than town B, and just prints more paper whenever they need more metals or tools. Imagine now if one day town B attempts to buy goods from A and they say, we don’t want your paper anymore, do you have anything else you can offer?

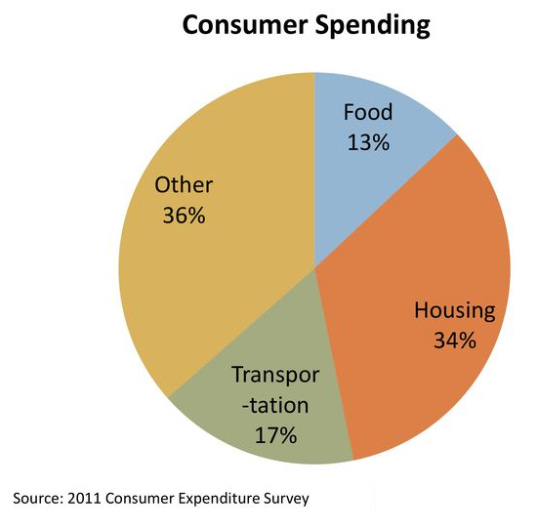

After immigration, the trade deficit was the 2nd largest arbitrage America was silently playing. America was exchanging pieces of paper for actual products produced by China and the rest of the world, and for the last 20 years, and increasing at a increasing rate, was exchanging these paper for ownership of Chinese companies. They were in fact buying something of real value for a useless piece of paper, of which 25% of the total supply have been created in the last 12 months to buy companies that Chinese have been working 80-120 hours a week for years to create. China manipulates it’s currency to be artificially low, it’s how the West is able to keep consumer “inflation” at 2%. The Yuan would be trading 40% higher if it was allowed to float in a free market. The Chinese consumers are being forced to pay a premium for foreign goods and travel. In exchange, they get export manufacturing jobs and rising real incomes. The West has pulled all levers to get to where we currently are, 1% mortgage rates, 0.09% margin rates, 25% currency printing over the last 12 months, todays (July 28, 2021) FED speech they are buying 80b monthly in government bonds + 40b monthly in mortgage backed securities. If interests were allowed to operate in a free float market (1-2% above inflation) we would see 5-6% mortgage rates + 5% lending rates, which would lead to a 40%+ drop in the market, (they can prevent this by printing more, which would then devalue the currency by the same ratio). Doing more deep dive using Edgar Company Search, we see that China has already pulled all of these levers, they have the highest mortgage rates in the world, highest interest rates in the world, the most difficult mortgage application process of all developed nations, and has artificially crashed their tech market by 55% via regulation that western nations are too scared to take (or simply cannot as it would crash the economy), while still growing GDP at the fastest rate in the world with 42 years of growth without a single recession. They are proactively preventing tomorrows problems today, whereas we in the west continue to kicked the can down the road and hope that the rest of the world will continue to exchange real assets for meaningless paper.

Takeaway

I would also like to add, this has been the most volatile 2 weeks in my investing life (especially considering my asset distribution). However my conviction is unchanged, and I am considering buying more after the public DIDI execution which as of the time of writing (July 28, 2021) is unknown. While China’s economy is not cyclical, the market is, this blog asks readers to question where is America and their tech in the current cycle, and where is China and China Tech (QQQ (USA) vs KWEB (China)) and invest accordingly. The largest fear I read on investing message boards is that the CPP makes policy randomly and at any point any company can be removed or nationalized, whereas it seems clear to this blog that they have well defined goals and decisions are made in the interest of the country and it’s people (not the stock market). Growth is responsible for 90-95% of all valuations over the long run, the remaining 5-10% is sentiment.

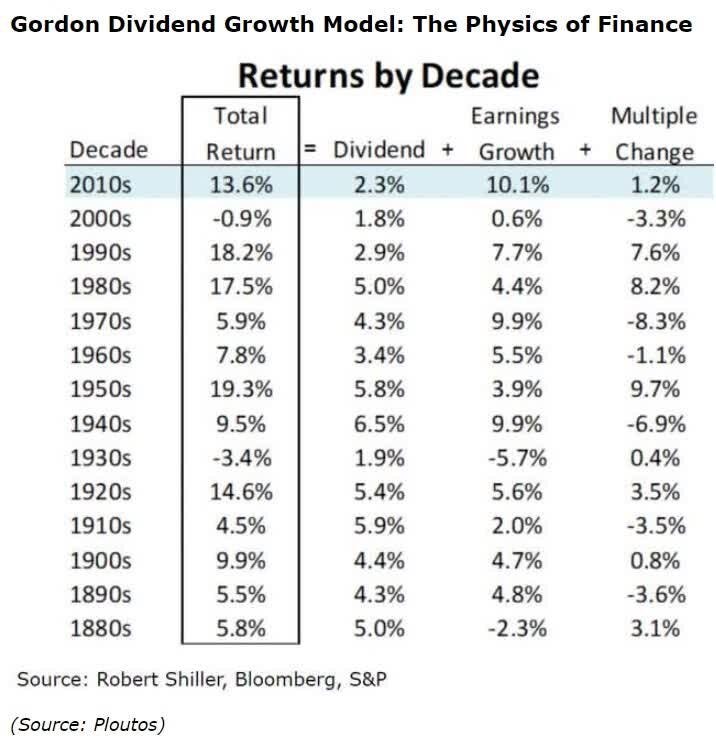

0% earnings growth from 2000-2010 led to a lost decade for the American investor as well as negative sentiment (hence the negative multiple change), similar sentiment occurred after the great depression into WWII, 1940’s, moving away from the gold standard the the cold war in the 70’s. Right now sentiment in America is near all time high, and like most human patterns, it is cyclical. While at the same time it’s all time low in China, whereas growth rates are inverted

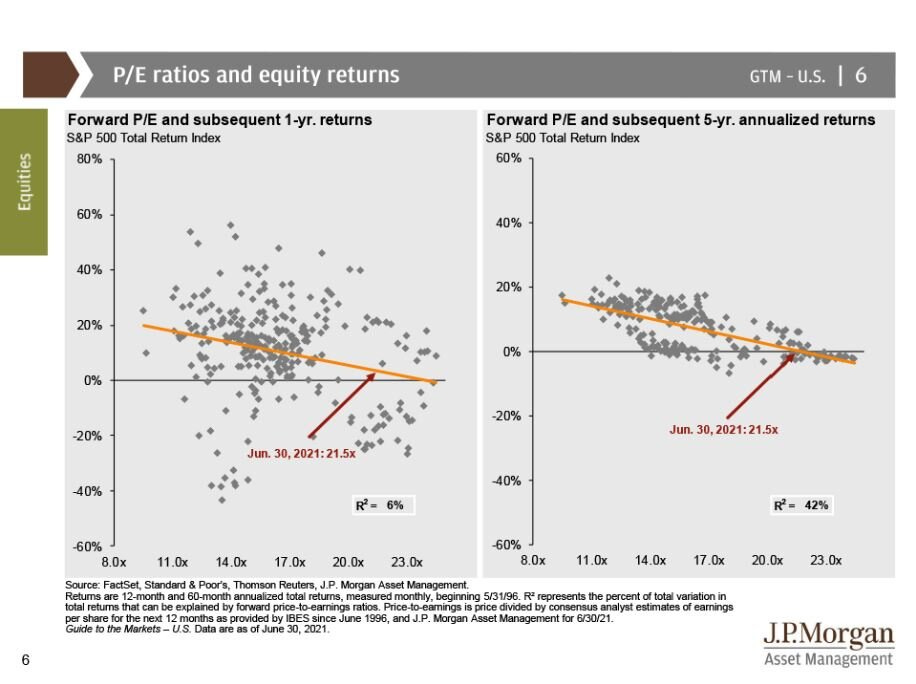

Valuations are in the top 5th percentile, inflows are the highest in history, but no economic growth to back it up for the SNP500. Perhaps the next 10 years will have record high corporate earnings and the re-emergence of the middle class with record high quality immigration with population expansion. However, the data suggests otherwise, this blog does not have a penny in the American equity market due to what is hopefully unbias representation of data.

Equity markets are like betting on horses, they are going to run and move forward, but we want to know who finishes the furthest ahead. With QE and monetary expansion, all markets will continue to grow and move ahead. But a 3% raise when inflation is reported at 5%, and houses are 35% more expensive may not feel like a win. Hope everyone has a great day, stay safe, and good luck.