The Chinese regulators continue the crackdown on all tech giants creating buying windows for long term investors.

Ping An has the most advanced ecosystem of insurance technology and products in the world

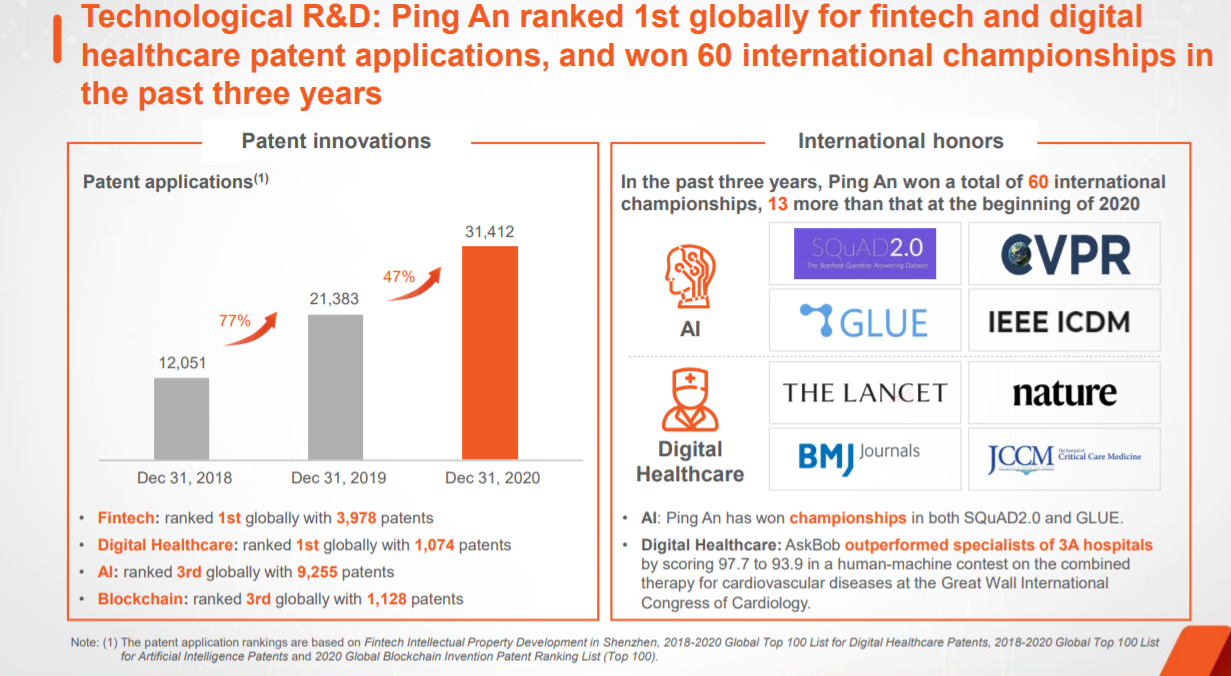

Ranked 3rd globally with AI patents, #1 in the world for Digital Healthcare and fintech patents (Take patents with a grain of salt)

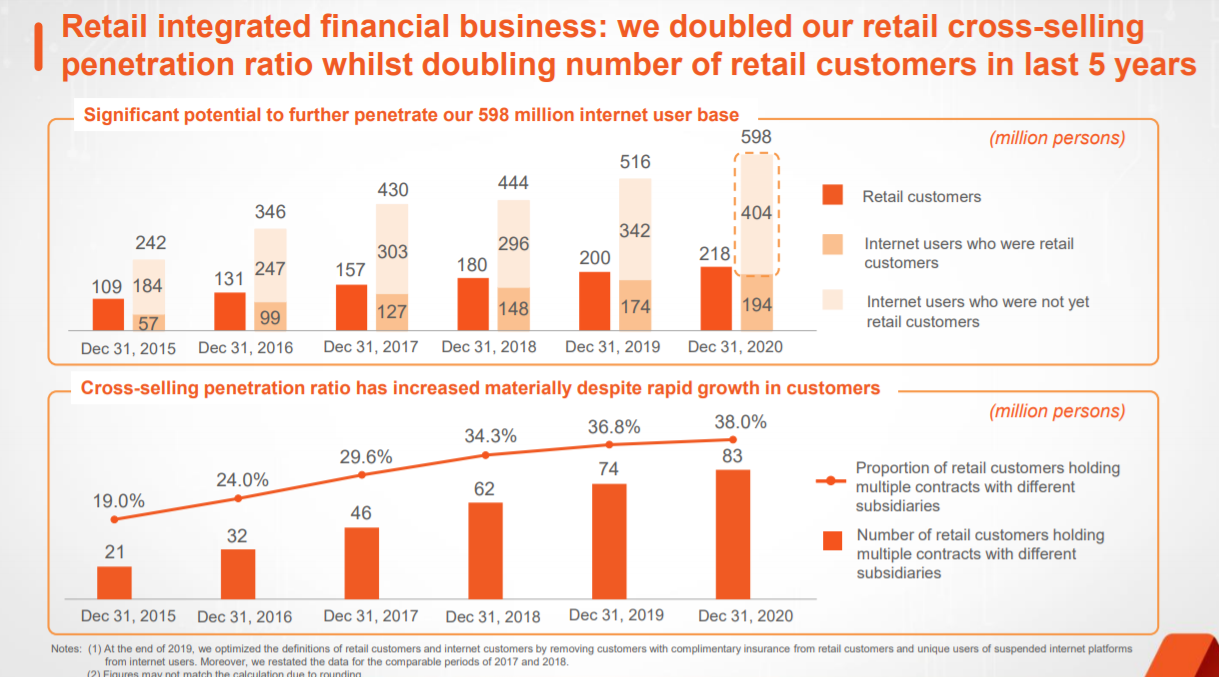

After doubling the customer base over the last 5 years to 380m, there is still room for another double over the next 5 years while selling additional products to current customers

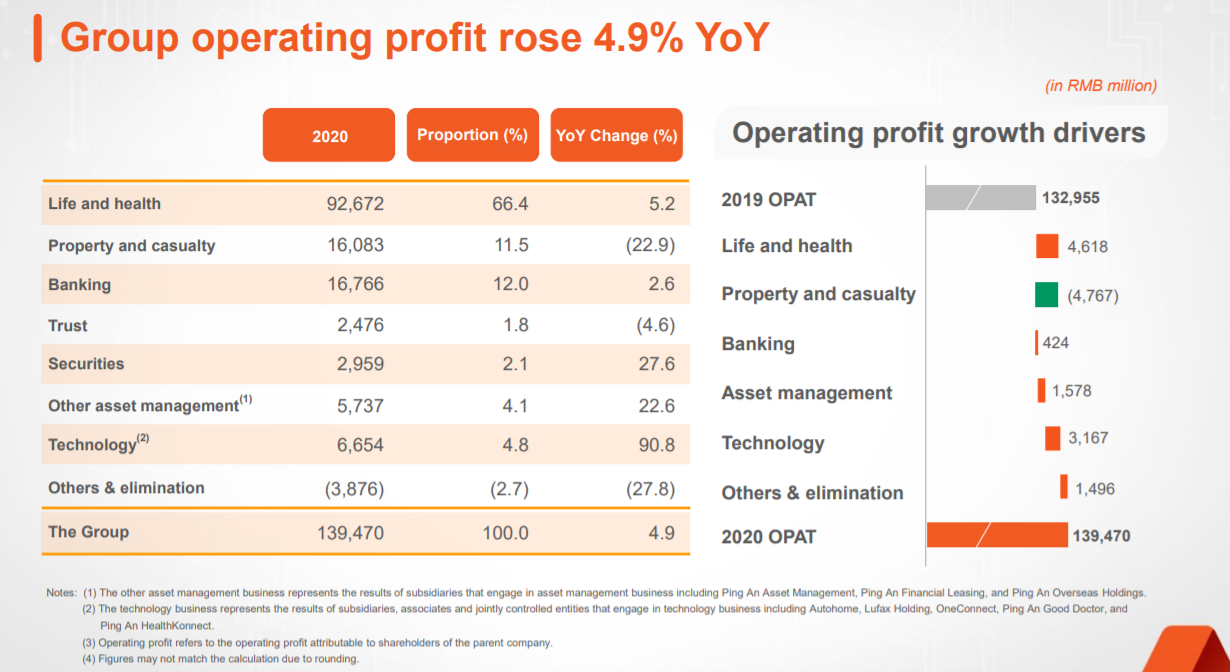

Ping An Insurance (Group) Company of China, Ltd. provides financial products and services for insurance, banking, asset management, and fintech and healthtech businesses in the People's Republic of China. Life and health represents the largest source of profit with almost 2/3 of all profits with Property and Casualty (P&C) and Banking almost tied for 2nd with 11-12% each.

Source : Ping An Investor Presentation

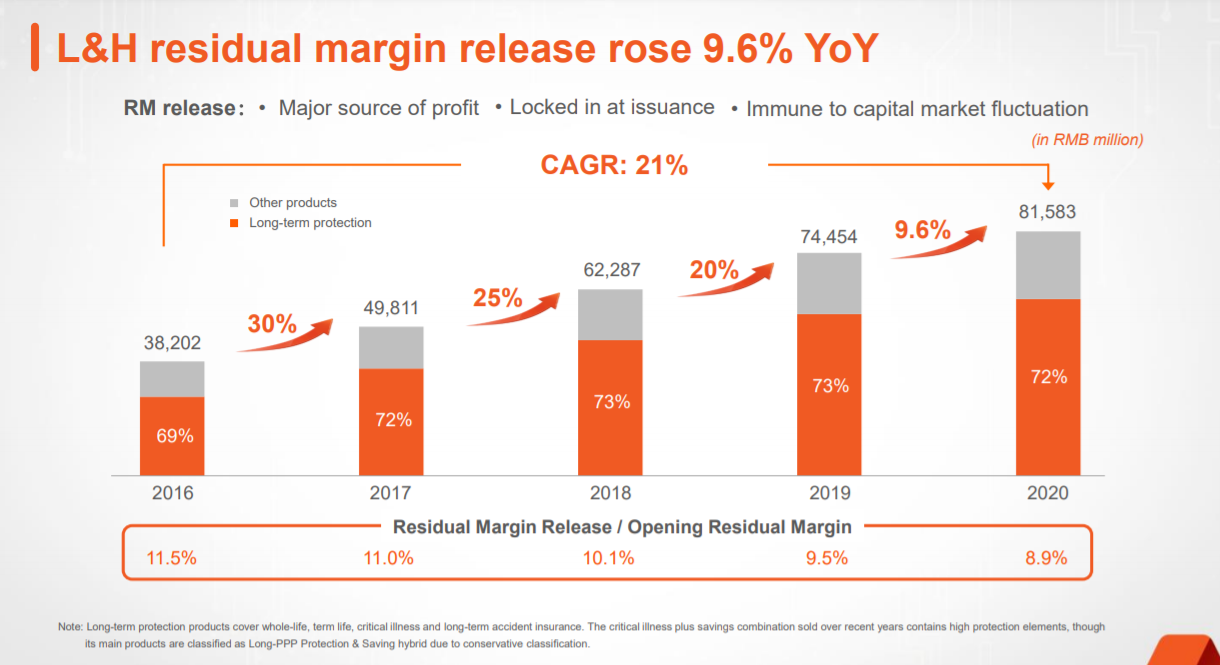

According to Finsheet, the world's leading provider for stock price in Excel, the largest component, L&H, experienced it’s slowest growth in 5 years which is consistent with other other global life insurers as the Covid19 caused a slowdown in net written premiums and a spike in mortality and margin contractions shown below.

Covid 19

Part of the uncertainty of this investment will be how post vaccine mortality rates will change, will we revert to historical levels and continue increasing human longevity or have we reached the peak? Prior to Covid19 the trend of increasing life expectancy, elimination of poverty, medicine, improving education standards globally etc.. was almost perpetual, and I don’t see this changing any time soon. With any improvements linked to technology (education in particular) accelerating. This is relevant as higher quality of life is directly proportional to higher lifespan.

The fastest growing segments are technology (AI, E-Doctor, internet penetration etc..), with 90%+ growth. Given the total investment and push towards technology, this has the potential to be the second largest segment within the next 5 years. This reflects in their stock price in Excel as it keeps hovering at the $55 mark.

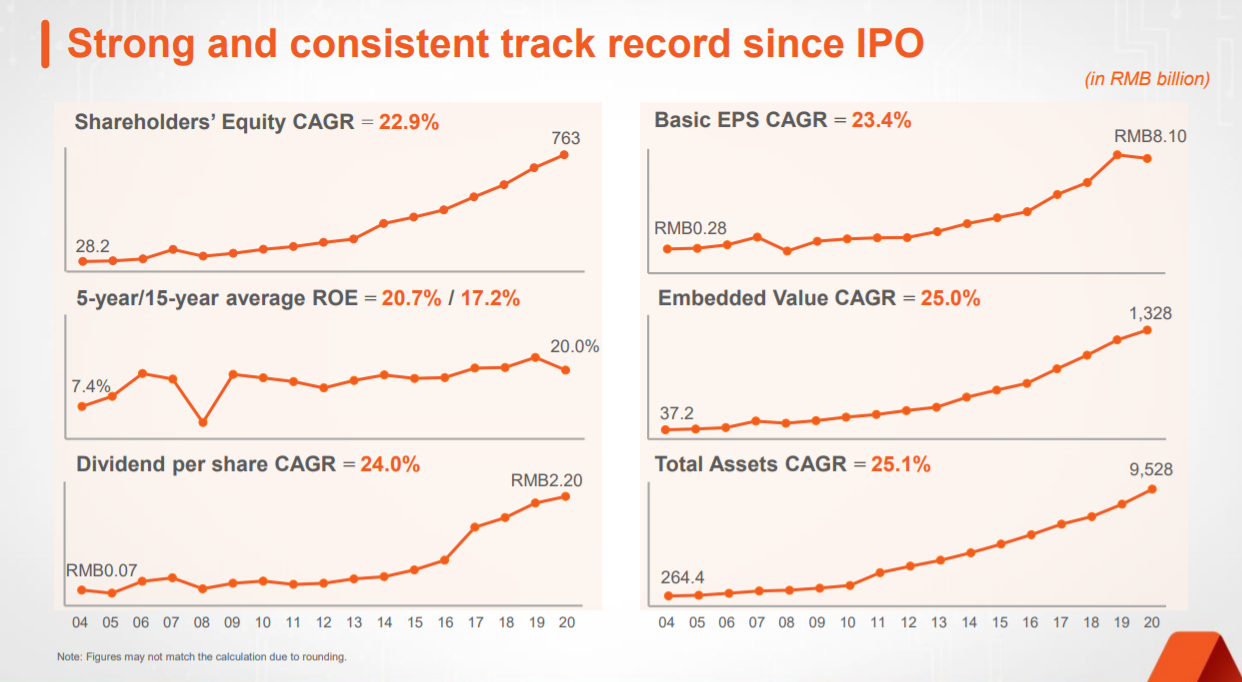

Growth story

Ping an is an mature highly profitable insurer with the growth rates of a tech startup. Over the last 5 years they have doubled their customer base and increased earnings by 23%, by contrast Google and Apple during the same period have grown by 15% annualized and 11% (keep in mind 15% CAGR results in a double exactly 5 years). It is the 15th most profitable company in the world, with no signs of slowing down. Their tech budget and patents are on par with any tech in the world.

Earnings

Over the last 5 years, earnings have not followed growth and Ping an has only doubled in value while currently trading at under 7.8 years earnings, lower than western insurers despite growing at double the rate, the ability to invest in 3.25% interest rates (the highest of any developed nation), have almost oligopolistic access to the fastest growing middle class in the world (which will transition into the regulator crackdown segment) and the most advanced technology offerings in of any insurer in the world. If we eliminate country of origin and name of the company, these specs in the west would typically command 2-3 the current valuation.

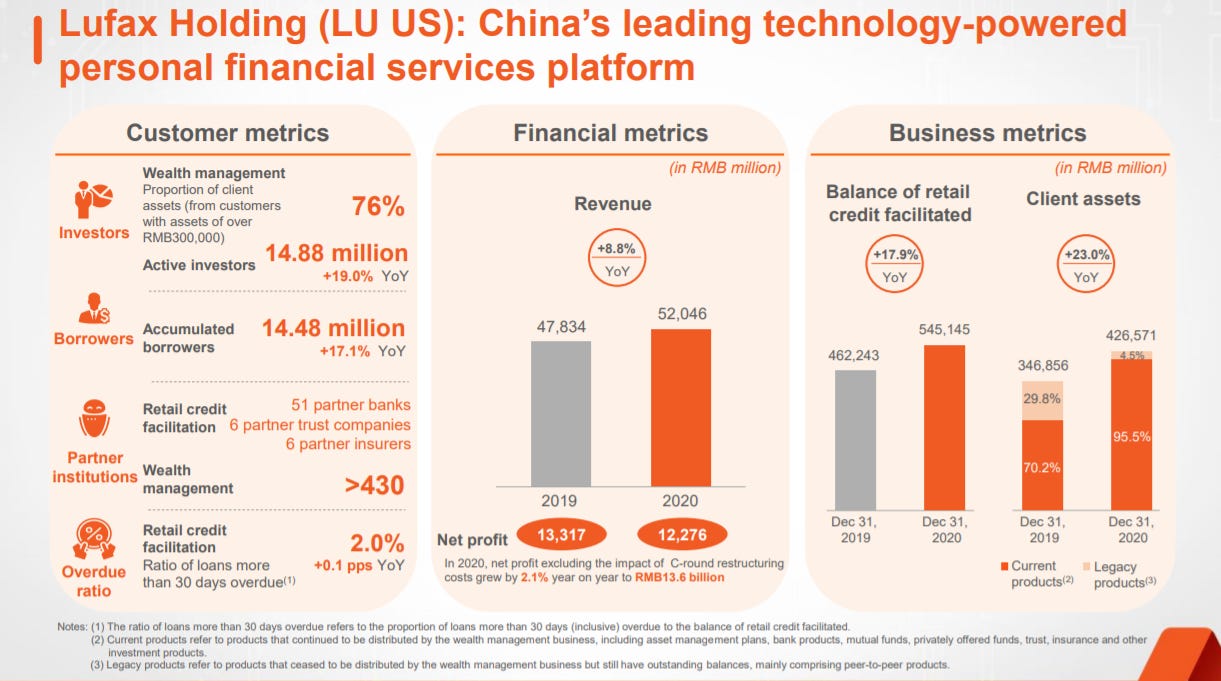

Lu Stake

Based on their stock price in Google Sheets, Ping An holds a 41% Stake in NYSE: LU. Lufax Holding Ltd operates a technology-empowered personal financial services platform in China. It offers loan products, including unsecured loans and secured loans, as well as consumer finance loans. The company also provides wealth management platform. This allows the middle class to invest in products and portfolios.

Current valuation of LU 27billion USD, down from 50 billion earlier this year (pre regulator crackdown), making Ping-Ans stake is currently valued at 11b down from almost 20b. This is something investors get for free as it does not add to earnings.

Valuation and Chinese Regulators

Before coming up with a valuation, lets explore the most profitable companies in the world for 2020 and the industries they operate in and how the market values them.

Source : Fortunes global 500 list

We are not comparing apples to apples here (slight pun intended), however we also cannot compare Ping An to western insurers, as it has

1) A significantly higher R&D budget comparable to a mega cap western tech company

2) The growth rate of a tech conglomerate (18.17 growth rate for Microsoft during the same period)

3) Access to an under-insured middle class whom will have the highest % increase in income of any developed country.

4) Highest federal interest rates of any developed nation with 3.107% 10 year treasury at the time of this blog, compared to 1.42% for USA and between -0.5% to 1% for European nations. Insurance is a difficult industry in a low interest rate environment, hence every time the rates are slashed the price of insurers plummets. I go in to deeper detail Swapping life for death and why I have removed all North American and European insurers from my watch list.

That said western insurers, and almost all western companies have higher multiples and only a fraction of the growth rate and tech budget + vision + execution, thus there is no clear peer I can use to compare to. So I will use basic fundamental valuation principles (like we tend to do anyway)

Fundamentals

Following up on how to get stock price in Excel, over the last 5-6 years Ping An has traded at half their growth rate while paying a 3% dividend, offering a 50%-55% margin of safety. If it reverts to historical average (which is still significantly undervalued), one can expect almost 60% upside today, and over 100% over the next 2.5 years. If they continue to trade at these levels caused by anti-china rhetoric compounded with regulator crackdown, we can expect 15% fundamental growth plus a 3.5% dividend yield for a 18-19% return while maintaining an almost 60% margin of safety.

If one discounts their current profit of 21.6 billion with 0% growth rate, we would require a 12% discount rate to reach the current value, the current price is beyond rational and is is almost implicitly suggesting that Chinese companies are uninvestable or the most under priced assets on planet earth, trading at 2007 financial crisis levels.

At the time of the writing Ping-An (Pngay in US Exchange or 2318.HK) is one of the most mispriced mega caps in the world at 73 HKD per share according to Finnhub Stock Api , and I expect it to out-perform all companies above it in the profit chart over the next 5 years. This blogs price target is 105 HKD to 150 HKD over the next 12 months